Summary

Scalable stock trading infrastructure designed for use by algos

Features

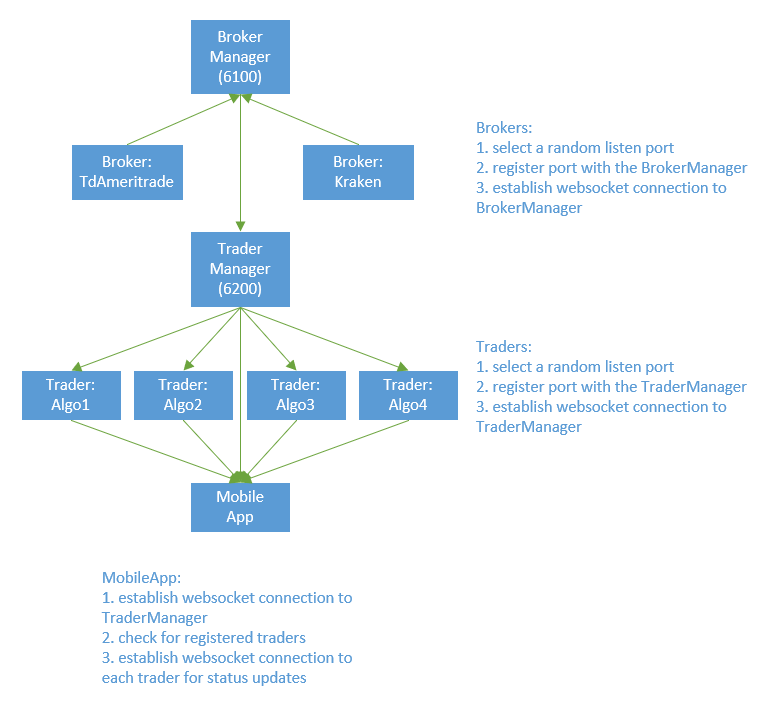

- Communication with multiple brokers, e.g. TdAmeritrade, Kraken

- Multiple connections to the same broker as needed

- Resources added as needed to handle increased load

- Brokers can change behind the scenes without impacting algos

- Designed with high availability in mind

- REST & WebSocket API

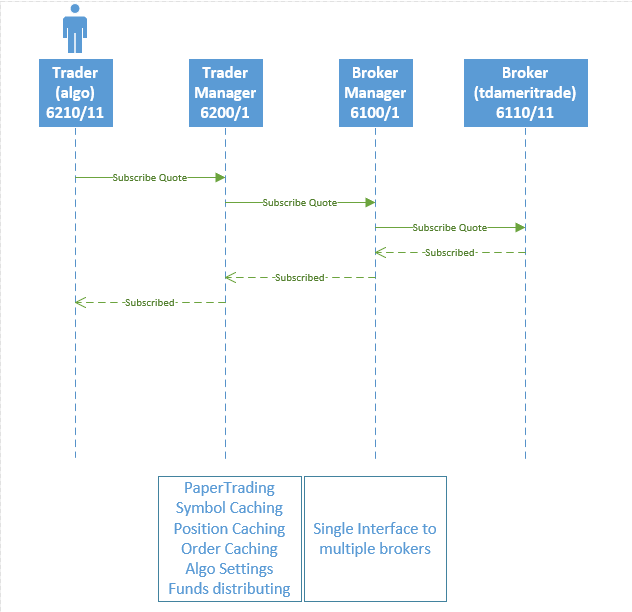

Definitions

- Broker – a broker such as tdameritrade or kraken

- Market – used to interact with exchanges without knowing which api is actually used behind the scenes

- Trader – a stock trading algo, a bot which automates stock trading algorithms

- BrokerManager – able to spin up & spin down brokers, provides status

- MarketManager – able to spin up & spin down markets, provides status

- TraderManager – able to spin up & spin down traders, provides status

- InfrastructureManager – overall status display & interaction with all Managers

Implementation

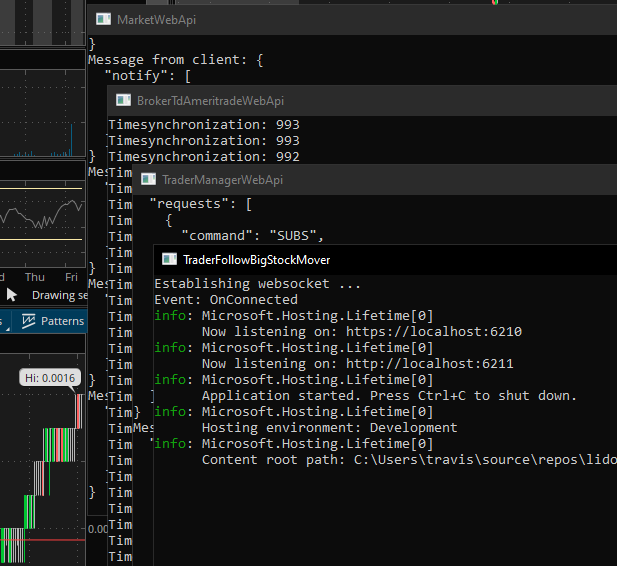

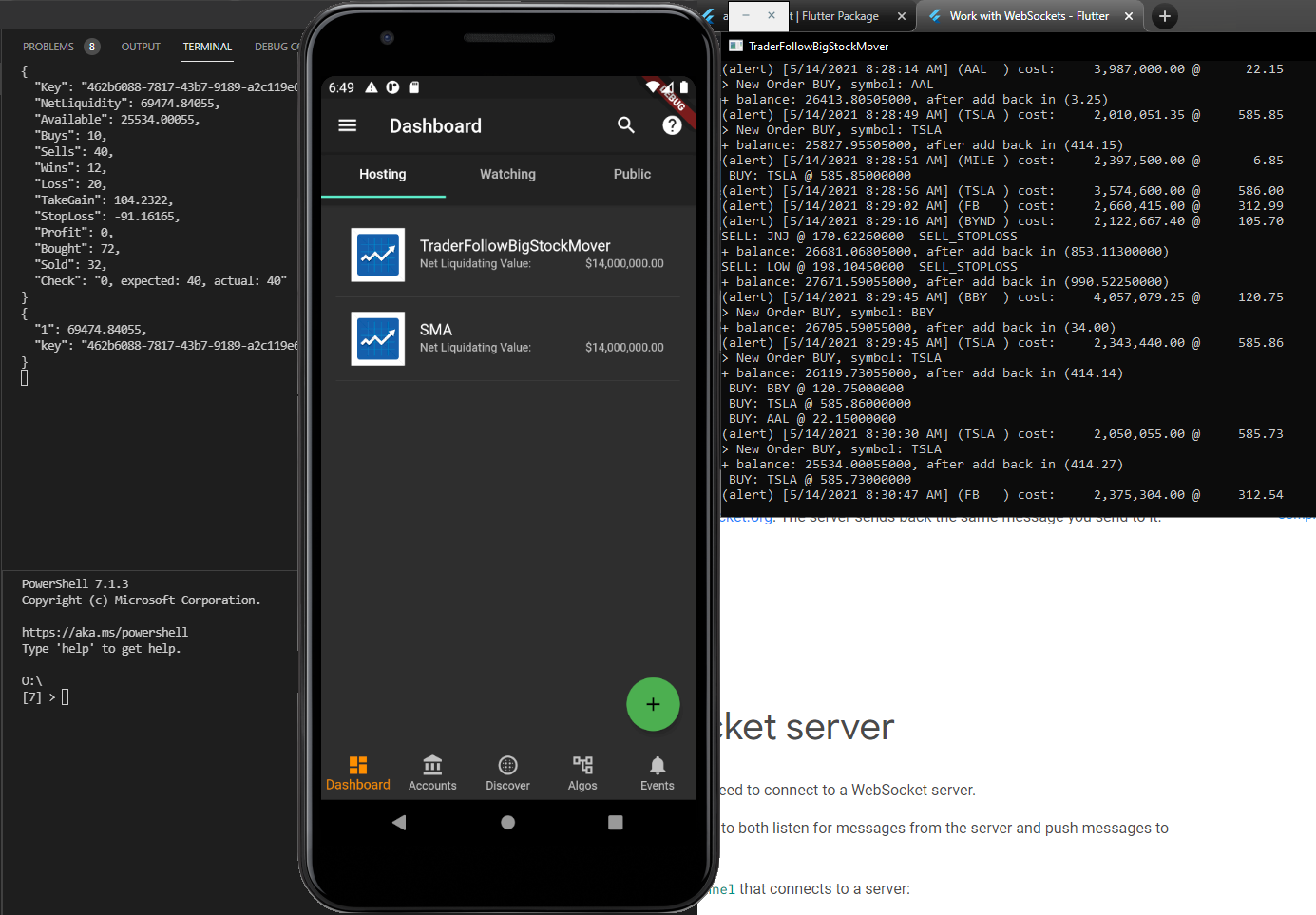

- Each service implemented with c# using combination of REST & WebSocket

- Distributed implementation

- At each location where a duplicate implementation exists, there will be the three managers.

- A location may have more than one implementation.

- A new implementation may be spun up at any time as demand requires

- An unused implementation may be flagged to no longer allow new connections and dropped afterhours

- Infrastructure Management

- As managers are spun up they check-in with one or more InfrastructureManager(s) which provide an overall view of the whole infrastructure

- Managers can be checked for status and monitored via WebSocket for status

- Customer

- Once connected, a customer algo will have access to a MarketManager

- Upon disconnection & reconnect, a customer algo will again have access to a MarketManager, but the actual servers may be different.

- For interacting with traders a customer can manage their own traders, or use a TraderManager. TraderManager(s) can be spawned as needed, but a customer will need to be able to use the same TraderManger for each of his Traders to connect with.

Interprocess Communication

- Traders, Markets, Brokers, upon being spawned, will checkin with their respective Manager via REST.

- The respective Manager then will establish a WebSocket connection with the spawned service. This will be the pipe used for two-way communcation.

- All dropped WebSocket connections are to be re-established by the party who originally created the WebSocket connection.

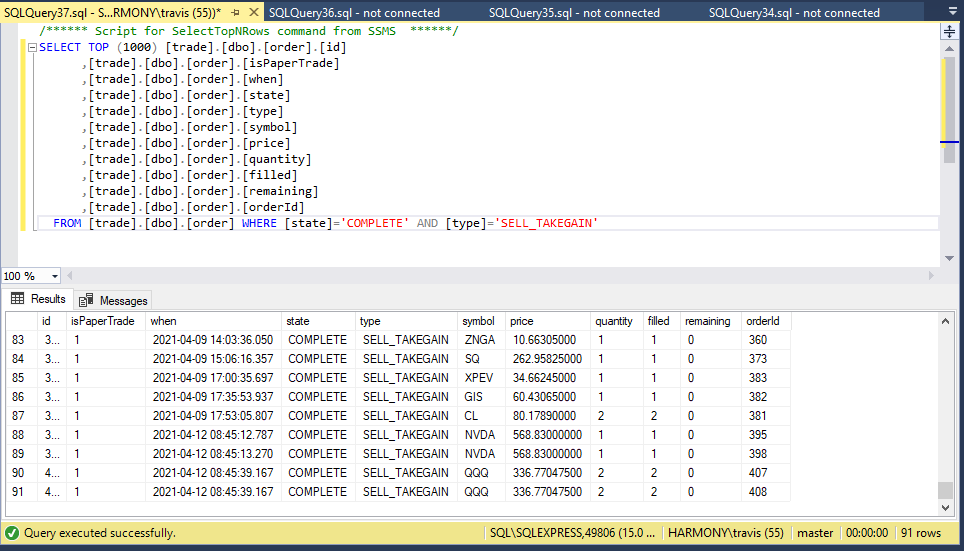

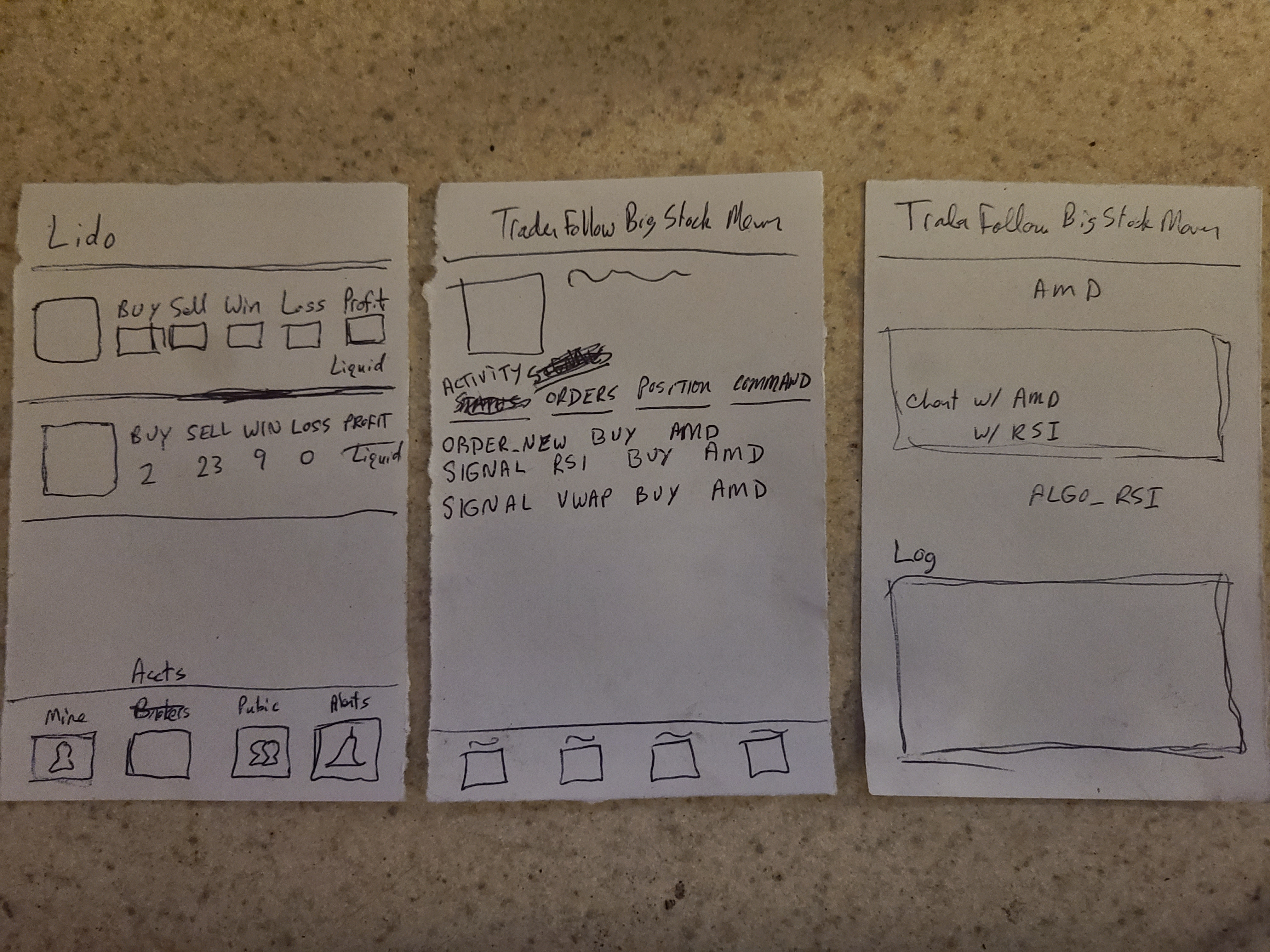

Active Development

Initial development phase